Credit Management

How credit impacts your life depends on how responsible you are. Credit can be a useful tool but it can also get you into trouble. You need to build credit in order to prove your credit worthiness. Once you accept credit, you enter into a contract to receive something of value now with a promise to pay the lender at some date in the future, with interest. An important thing to remember is that credit extends beyond the purchase of goods. Landlords, loan lenders and some employers will review your credit and payment history. A good payment history demonstrates responsibility, a trait most employers seek. The goal of credit management is to show those who inquire about your credit that you are responsible and able to control your spending. Graduate students often rely on credit to finance their education and living expenses, making effective credit management crucial for long-term financial success.

Credit Report

- www.annualcreditreport.com

- www.creditkarma.com

- You can request a free credit file disclosure, commonly called a credit report, once

every 12 months from each of the nationwide consumer credit reporting companies: Equifax,

Experian and TransUnion.

Disputing Errors on Credit Reports - Tell the credit reporting company, in writing, what information you think is inaccurate. Sample Dispute Letter - Consumer Credit Reporting Companies

- Equifax

O. Box 740241

Atlanta, GA 30374-0241

1-800-685-1111 - Experian

O. Box 2104

Allen, TX 75013-0949

1-888-EXPERIAN (397-3742) - Trans Union

O. Box 1000

Chester, PA 19022

1-800-916-8800

- Equifax

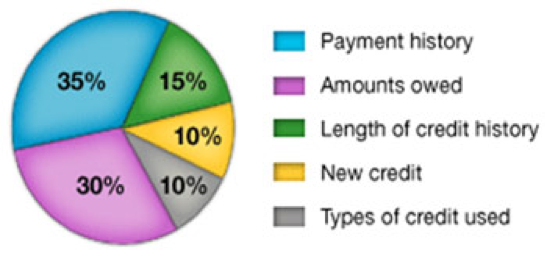

How a FICO Credit Score Breaks Down:

Credit Score

- Use secured credit cards. A secured credit card is just like a regular or unsecured credit card, you are required to put down a security deposit to provide assurance to the creditor that you will repay your debt. Your credit limit is often the amount of your security deposit or a percentage.

- Use store credit cards. Make sure you are aware of the interest rate and try to pay off the balance each month.

- Use gasoline credit cards.

- Place your apartment utilities in your name.

- Pay your bills on time.

- Keep your credit card balance(s) low or at zero.

- Manage your debt.

- Check your credit report regularly.

- Do not bounce checks.

- Only apply for credit you need. If you close a credit card account, your credit score may decrease.

- Contact your lender if you fall behind on your payments

By following these steps, you'll start to establish a solid credit history and improve your credit score over time. Keep in mind that building credit takes patience and responsibility, but it is a crucial part of financial stability.