Building Good Credit

Understanding Credit Scores and Their Impact on Financial Success

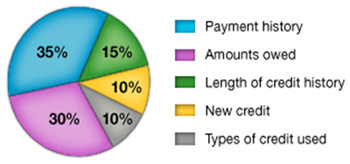

A good credit score is essential for financial stability and access to credit opportunities. A credit score is a three-digit number calculated from your credit report and is a key factor used by lenders to determine your creditworthiness for mortgages, loans, and credit cards. Your score influences not only whether you are approved for credit but also the interest rates you receive.

Generally, a good credit score is considered to be 720 or higher, though individual lenders may have different standards. Maintaining a strong credit score helps secure the most favorable interest rates and higher chances of credit approval.

Graduate PLUS Loan Credit Check Requirements

The Federal Direct Graduate PLUS Loan requires a credit check as part of the application

process. Your credit history impacts your eligibility to borrow, and you may be considered

to have adverse credit history if:

You are 90 or more days delinquent on any debt, OR

Within the last five years, you have experienced a default determination, bankruptcy

discharge, foreclosure, repossession, tax lien, wage garnishment, or a federal student

aid debt write-off.

Key Details About the PLUS Loan Credit Check

Credit approval is valid for 90 days. Each time you request a new PLUS loan, your

credit will be evaluated unless a decision has been made in the past 90 days. The

credit check does not evaluate the amount of your debt but instead assesses your history

of making timely payments.

Options If You Have Adverse Credit History

If you are denied due to adverse credit history, you may still obtain a Direct PLUS

Loan by:

Obtaining an endorser (co-signer) who does not have an adverse credit history.

The Endorser Addendum process must be completed in one session and takes about 30

minutes.

You will need to:

Enter personal, loan, and reference information.

Consent to a credit check.

Read and agree to the terms and conditions.

Electronically sign and submit the form.

Appealing the denial by contacting Federal Student Aid Applicant Services at 1-800-557-7394

if:

The adverse credit decision was based on incorrect or outdated information.

You can demonstrate extenuating circumstances related to your credit history.

(Note: Endorsers are not eligible for this appeal process.)

Maintaining good credit is vital not only for loan approvals but also for long-term

financial health. By staying informed and taking proactive steps to manage your credit,

you can improve your financial future and borrowing opportunities.

The Importance of Identity Theft Protection for Graduate Students

Graduate students are particularly vulnerable to identity theft due to their frequent transitions—moving between schools, handling student loans, managing research grants, and sometimes working multiple jobs. Here’s why identity theft protection is crucial:

Financial Security – Many graduate students rely on financial aid, assistantships, or student loans.

Identity theft can lead to fraudulent activity that impacts credit scores, making

it harder to secure loans, rent apartments, or even find employment.

Academic & Research Risks – If personal or institutional data is compromised, research work, academic records,

and university accounts could be at risk, leading to severe consequences such as plagiarism

accusations or data breaches.

Frequent Use of Public Networks – Graduate students often access personal accounts through public Wi-Fi in libraries,

coffee shops, and university buildings, increasing the risk of cyber theft.

Time & Legal Burden – Dealing with identity theft can be a long and stressful process. Recovering lost

funds, correcting credit reports, and securing accounts can take valuable time away

from research and coursework.

Personal & Professional Reputation – A stolen identity could be used for fraudulent activities that damage a student’s

reputation.

How Graduate Students Can Protect Themselves

- Regularly monitor bank accounts and credit reports.

- Use strong passwords and enable multi-factor authentication.

- Avoid sharing personal information on unsecured platforms.

- Be cautious of phishing emails and scams targeting students.

- Shred personal documents and limit exposure of Social Security numbers.

For more infomation: Federal Trade Commission - Consumer Information

Credit Bureaus

You can request a free credit file disclosure, commonly called a credit report, once every 12 months from each of the nationwide consumer credit reporting companies: Equifax, Experian and TransUnion.

AnnualCreditReport.com is the official site to help consumers to obtain their free credit report.

Disputing Errors on Credit Reports - Tell the credit reporting company, in writing, what information you think is inaccurate. Sample Dispute Letter

Consumer Credit Reporting Companies

Equifax

P.O. Box 740241

Atlanta, GA 30374-0241

1-800-685-1111

Experian

P.O. Box 2104

Allen, TX 75013-0949

1-888-EXPERIAN (397-3742)

Trans Union

P.O. Box 1000

Chester, PA 19022

1-800-916-8800