1098-T Information

In previous years, your 1098-T included a figure in Box 2 that represented the qualified tuition and related expenses (QTRE) we billed to your student account for the calendar (tax) year. Due to a change to institutional reporting requirements under federal law, beginning with tax year 2018, we will report in Box 1 the amount of QTRE you paid during the year.

Depending on your income (or your family’s income, if you are a dependent), whether you were considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit. (You can find detailed information about claiming education tax credits in IRS Publication 970, page 9.)

The dollar amounts reported on your Form 1098-T may assist you in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim as part of your tax return.

The University of Tennessee is unable to provide you with individual tax advice, but should you have questions, you should seek the counsel of an informed tax preparer or adviser.

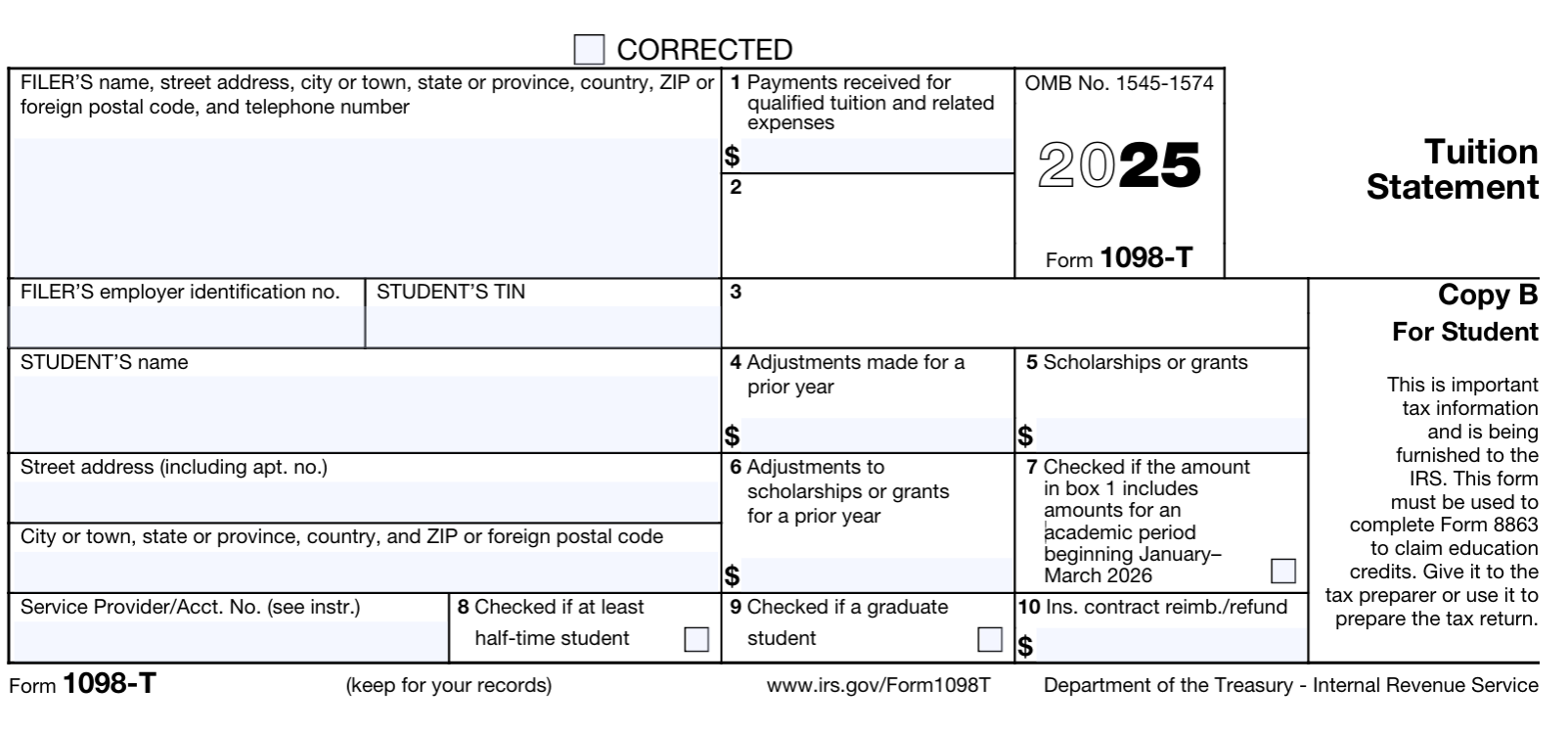

Below is a blank sample of the 2025 Form 1098-T, that you received in January 2026, for your general reference. For more information about Form 1098-T, visit https://www.irs.gov/pub/irs-pdf/f1098t.pdf.

Frequently Asked Questions

As determined by the federal government, qualified expenses are defined as expenses required by and paid to the institution for enrollment purposes. They include maintenance, tuition, technology fee, course fee and a portion of the programs and services fee.

Non-qualified expenses are defined as books, room and board, student activities, parking, insurance, equipment, or other similar personal living expenses.

As a result, the amount of qualified expenses will likely be less than the total amount of money paid.

You may print a copy of your 1098-T online.

Contact the Bursar’s Office at 901.448.5552 or cashier@uthsc.edu. if you have questions about the form.

Please note that the University of Tennessee Health Science Center is prohibited from discussing or disclosing any student information over the telephone or to anyone other than the student themselves. The University cannot send a student’s 1098-T directly to a parent or tax preparer. The student will need to provide the 1098-T to his/her parent or tax preparer.

Federal law requires and ensures privacy of information through FERPA - the Family Education Rights and Privacy Act. For access to tax information and for faster responses to your inquiries, please follow all instructions and required procedures.

Box 1- The total payments from any source received by an eligible educational institution in 2018 for qualified tuition and related expenses less any reimbursements or refunds made during 2018 that relate to payments received during 2018. Please note the amount in Box 1 will NOT equal to or sum to the charges paid for calendar year 2018 because all charges are not considered qualified tuition and related expenses as defined by the Internal Revenue Service. Health fees and counseling fees are not qualified; therefore, the full amount of the Program and Services Fee paid will not be reported.

Box 2- Blank

Box 3-Shows whether the University of Tennessee changed its method of reporting for 2018. This box will be checked.

Box 4- The amount of any adjustments made for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount may reduce any allowable education credit you may claim for the prior year. See Form 8863 or the IRS Pub 970 for more information.

Box 5- This box includes the total of all scholarships, grants, Internal NPE’s and fee waivers administered and processed by the University.

Box 6- This will be the amount of any adjustments made for prior year scholarships, Internal NPE’s grants, and fee waivers that were reported on a prior year Form 1098-T. This amount may reduce any allowable education credit you may claim for the prior year. See Form 8863 or the IRS Pub 970 for more information.

Box 7- If checked indicates that Box 1 includes amounts for an academic period beginning in the next calendar year beginning January-March. See the IRS Pub. 970 for how to report these amounts.

Box 8- Indicates whether you are considered to be carrying at last one-half the normal full-time workload for your course of study at the University of Tennessee. If you are at least a half-time student for at least one academic period that begins during the year, you meet one of the requirements for the Hope credit. You do not have to meet the workload requirement to qualify for the tuition and fees deduction or the lifetime learning credit.

Box 9- Indicates whether you are considered to be enrolled in a program leading to a graduate degree, graduate-level certificate, or other recognized graduate-level educational credential. If you are enrolled in a graduate program, you are not eligible for the Hope credit, but you may qualify for the tuition and fees deduction or the lifetime learning credit.

Box 10-This box will always be blank on 1098-T form the student receives from the University of Tennessee.

The University cannot provide tax advice. Please consult your tax professional to find out more about your eligibility for tax credits and/or the taxability of your scholarships.

The University of Tennessee Health Science Center reports amounts billed in box 2 for qualified fees and not paid. If you have additional concerns, contact the Bursar Office at 901.448.5552 or cashier@uthsc.edu.

Due to a change to institutional reporting requirements under federal law, beginning with tax year 2018, the university will report in Box 1 the amount of payments received for qualified tuition and related expenses paid during the calendar tax year 2018. If you have additional concerns, contact the Bursar Office at (901) 448-5552 or cashier@uthsc.edu.